Last week I wrote a blog post about my evolution as a day trader. If you haven’t seen it yet, I strongly recommend that you click the link above to read it in full. It will give you an idea of where I am right now as a day trader. And if you prefer a video, it’s right below this paragraph. There I described my new day trading style and why I thought it was essential to make adjustments to my strategy and tweak the rules that I have developed for myself.

This week, I’d like to go a bit deeper into the process of changing a trading style: how to know when it’s time to make the changes, where to start, and how to develop a new working strategy.

Before we continue, please remember that every day trader is absolutely different. What works for me might not work for you, and vice versa. So please take everything that I write with a grain of salt. This is my personal experience, my conclusions, and my journey. If you think that you need a change just like I did, please make sure to adapt these steps for yourself, your trading style, and your habits.

Now that the introduction is out of the way, let’s get started.

Day trading wasn’t the same as before

So, half a year or so ago, I had to admit to myself that my old style of day trading wasn’t working for me anymore. Don’t get me wrong, I did well in terms of winning rate and the overall monetary gain. However, I lacked growth, and sometimes I felt like my profit didn’t amount to much after all the fees have been paid. I still had fun when day trading, and I was progressing and getting better, but things weren’t going as well as I hoped.

The main reason for that was that I pigeonholed myself into a very niche type of setup. And while I was happy with each individual trade’s profits, my monthly totals were underwhelming. Honestly, I just didn’t get to trade too often. I’ve literally had week-long breaks between the trades, and that was quite frustrating. I felt like I was missing out on so many opportunities, but I didn’t want to five into FOMO. I tried broadening the types of tickers I traded before, and it didn’t work out for me too well. No wonder, since trading out of boredom is never a good idea.

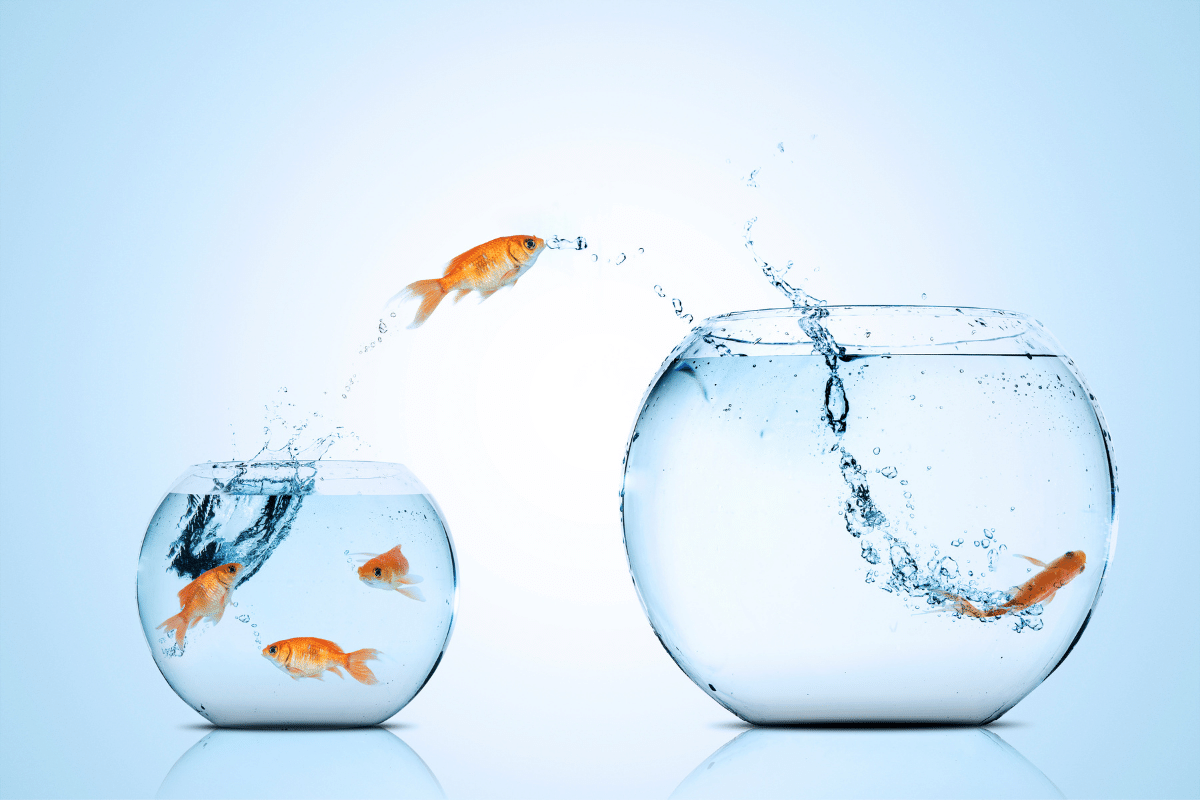

This is the biggest problem with creating strict rules and limiting yourself to prime setups only. On one hand, this is what you’re supposed to do in order to get your win rate and discipline to a new level. On the other hand, the more selective you are, the smaller is your window of opportunity. At first, this trade-off seems to be beneficial since you eliminate most of the losses. However, you also severely limit your growth, and you become a one-trick pony. You don’t lose much anymore, but you also don’t make much, and the opportunity cost only gets higher with time. And then you’re stuck between a rock and a hard place, not being able to trade the setups you know well, and not wanting to trade random stuff because it always leads to a loss.

Of course, there’s still paper trading, and you can still track other trades to see if you can develop a new strategy. However, trading paper money is never the same for me. Truth be told, I act in a different way when there’s no real risk. So I still get the data for my research, but I hardly gain any experience or get the right feel for the new strategies and patterns. For me, it’s easier to decrease my size rather than do paper trades.

Long story short, by June 2020, I knew that I couldn’t keep trading the way I’ve been doing it all these years. Something had to change, and I knew that I needed to diversify my setups.

Getting caught up in the outside noise

So I started looking for new ways to trade. Looking for a new direction, I turned to the few chat rooms that I was a part of at the time. I picked up some advice here and there and experimented a bit. Overall, there was some progress, but I was chasing too many things at once. I fell into the same trap I did before. You see, trading more often doesn’t automatically earn you more profit, at least not until you know exactly what you’re doing. And back then, I was a bit lost.

I was relying on other people’s opinions and experience a bit too much. Everywhere you go, you hear that you should stick to your plan. Well, what happens when you start sticking to other people’s plans? You start getting confused and lose the confidence that you had in yourself as a day trader. Someone else’s plans rarely work out; you have to adapt them to your own style before they become useful for you.

On the bright side of things, my long trades started getting better. Unfortunately, I was still all over the place in terms of trading random setups, so my first month I barely broke even. To be more precise, I was in the green, but trading fees ate up whatever profit I had.

Expanding and evolving takes time, patience, and trust in yourself

And that’s another thing about transitioning and evolving. Whenever you shake things up, you have to expect some fallout. It will take some time to get to the previous profit level. Plus, you’re putting yourself through the learning curve again. Just like before, you’re going to need to spend some time doing extensive research. Additionally, journaling worked really well for me. During the transition period, I made sure to record my watchlist, my guesses, my trades, and the results. I also wrote down how I felt doing it. Whenever you’re making significant changes, you have to listen to your gut. Recording how you feel helps you see if your gut feeling is right or wrong, and you can draw a sense of confidence out of this whole experience.

And trust me, you’re going to need it. My first month was full of random experiments, confusion, and poor execution. There was too much conflicting advice, so there was only one way out. I needed to regain control of my trading by doing what I, not anybody else, thought was right.

By then, I found a mentor who was helping me on my journey. I also interviewed many consistently profitable traders who were sharing insightful tips and trading advice. My biggest challenge was to rediscover my own voice. My goal was to use all the knowledge that has helped other traders become successful, take it apart, and see what can be borrowed and adapted to serve me. If you’ve been following me for a while, you know how specific I am about never copying someone else’s style and strategies. This is not about infringement or anything like it; it simply doesn’t work.

All tickers can be traded in multiple ways. Sometimes I go long on the stock that my mentor shorts. Sometimes we both win. Sometimes only one of us wins, and sometimes both of us are wrong. Timing matters, and so does the angle. You don’t have to agree with your mentor or your trading buddies in order to make a profit. Stick to your own plan, not theirs. And don’t become dependent on anyone else’s opinions. Even if you have a mentor, they’re not there to hold your hand or tell you when to exit or enter. A mentor is there to guide you, not to hover over your shoulder and triple-check your every move.

After I made my changes, time and persistence took care of the rest. Now I trade multiple setups, go both short and long, and sometimes run up to 10-12 trades a day. It’s pretty impressive since I started at 3-5 trades per week.

The main takeaway is that the market has multiple opportunities at any given time. If you’re niching yourself too much, you’re leaving a lot of money on the table. This is how you know that it’s time to branch out and try something new. But the timing has to be right. Make sure that you have enough knowledge, experience, and discipline to try out new things, and remember that you’re the one pulling the trigger. The final decision is always up to you!

Comments Off on Evolving Your Day Trading Style To Fit New Goals